Open the Benefits of Engaging Debt Consultant Services to Browse Your Course In The Direction Of Financial Obligation Alleviation and Financial Flexibility

Engaging the services of a debt consultant can be a critical action in your trip in the direction of accomplishing financial obligation relief and financial stability. These specialists supply customized techniques that not only assess your one-of-a-kind economic scenarios however also provide the important guidance required to navigate complex arrangements with lenders. Understanding the multifaceted advantages of such experience might reveal alternatives you hadn't formerly taken into consideration. Yet, the question continues to be: what certain advantages can a financial debt specialist offer your monetary situation, and just how can you identify the appropriate partner in this undertaking?

Recognizing Financial Obligation Professional Services

Exactly how can financial debt specialist solutions change your financial landscape? Financial obligation professional solutions supply specialized guidance for individuals facing financial challenges. These experts are educated to assess your financial circumstance thoroughly, giving customized strategies that line up with your special conditions. By evaluating your earnings, financial obligations, and expenditures, a financial debt consultant can help you identify the source of your monetary distress, permitting an extra exact strategy to resolution.

Financial obligation specialists normally use a multi-faceted strategy, which might include budgeting aid, arrangement with financial institutions, and the growth of a calculated payment plan. They act as middlemans between you and your lenders, leveraging their know-how to discuss a lot more beneficial terms, such as reduced rate of interest or prolonged payment timelines.

In addition, financial debt experts are geared up with current understanding of relevant regulations and guidelines, guaranteeing that you are educated of your legal rights and options. This expert guidance not just minimizes the emotional problem related to financial debt however also equips you with the tools required to regain control of your financial future. Ultimately, engaging with financial obligation consultant services can bring about a more organized and informed path toward financial security.

Key Benefits of Specialist Guidance

Engaging with financial debt consultant services provides numerous advantages that can dramatically enhance your monetary circumstance. Among the primary benefits is the competence that professionals bring to the table. Their substantial expertise of debt administration methods allows them to tailor options that fit your one-of-a-kind circumstances, guaranteeing an extra reliable approach to achieving financial stability.

Furthermore, financial obligation professionals often offer settlement help with lenders. Their experience can cause extra desirable terms, such as reduced rates of interest or worked out debts, which may not be achievable through direct arrangement. This can cause significant financial alleviation.

Furthermore, experts offer an organized strategy for settlement, aiding you focus on financial obligations and assign resources efficiently. This not just streamlines the payment process yet additionally promotes a sense of accountability and progression.

Eventually, the combination of professional assistance, negotiation abilities, structured settlement plans, and emotional assistance settings financial obligation specialists as valuable allies in the search of financial obligation relief and economic flexibility.

How to Pick the Right Professional

When choosing the right financial debt expert, what crucial factors should you consider to guarantee a favorable outcome? Initially, evaluate the specialist's certifications and experience. debt consultant services singapore. Search for certifications from recognized companies, as these suggest a level of expertise and understanding in the red monitoring

Following, think about the specialist's reputation. Study online evaluations, testimonials, and rankings to gauge previous clients' satisfaction. A solid record of effective debt resolution is crucial.

Furthermore, review the specialist's technique to debt management. A great professional ought to use customized solutions customized to your unique monetary situation as opposed to a one-size-fits-all option - debt consultant services singapore. Transparency in their procedures and charges is important; ensure you understand the expenses entailed prior to committing

Communication is one more key factor. Pick an expert who is friendly and eager to address your concerns, as a solid working partnership can improve your experience.

Usual Debt Relief Approaches

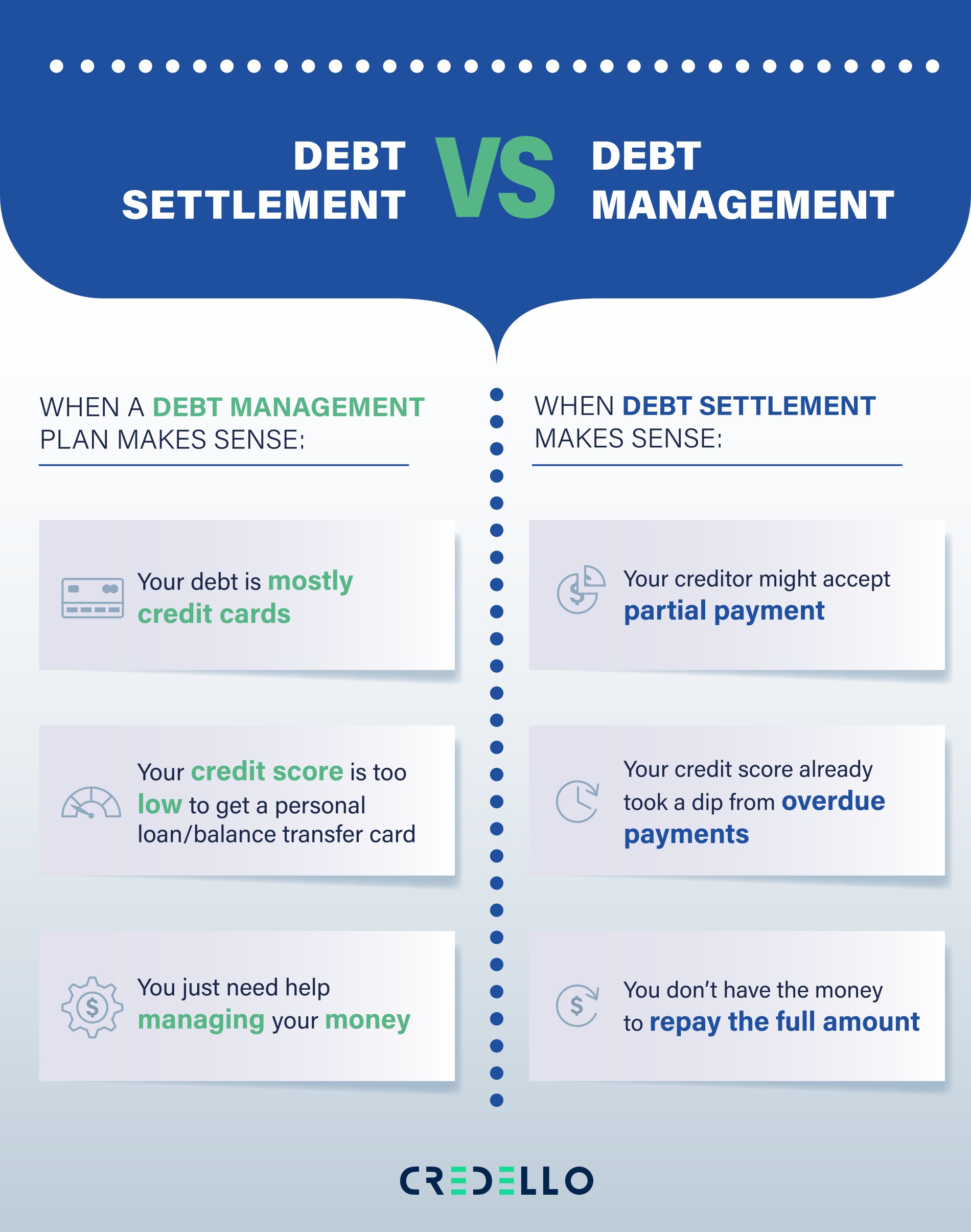

While different financial obligation alleviation methods exist, picking the ideal one relies on specific monetary conditions and objectives. A few of one of the most typical techniques include debt consolidation, financial debt monitoring strategies, and financial obligation settlement.

Debt debt consolidation includes combining multiple financial debts right into a solitary financing with a reduced rate of interest. This approach streamlines repayments and can minimize monthly commitments, making it simpler for individuals to reclaim control of their funds.

Debt monitoring plans (DMPs) are made by debt counseling firms. They work out with financial institutions to lower rate of interest and produce an organized layaway plan. This option enables people to pay off financial obligations over a set period while gaining from specialist assistance.

Financial debt settlement entails bargaining directly with more info here lenders to settle financial obligations for much less than the total quantity owed. While this approach can give immediate relief, it may influence credit report and frequently includes a lump-sum settlement.

Last but not least, bankruptcy is a legal choice that can supply remedy for frustrating debts. However, it has long-lasting economic implications and ought to be taken into consideration as a last hotel.

Selecting the proper approach requires careful examination of one's economic scenario, guaranteeing a customized strategy to achieving long-lasting stability.

Steps In The Direction Of Financial Liberty

Following, develop a practical spending plan that focuses on basics and cultivates financial savings. This spending plan needs to consist of stipulations for financial debt debt consultant services singapore settlement, permitting you to allot excess funds properly. Complying with a budget plan helps cultivate self-displined investing routines.

When a budget plan is in place, take into consideration involving a financial obligation expert. These experts offer tailored approaches for handling and minimizing financial obligation, offering understandings that can quicken your trip towards economic flexibility. They may advise choices such as financial obligation consolidation or arrangement with lenders.

Additionally, emphasis on constructing an emergency fund, which can protect against future financial pressure and provide peace of mind. With each other, these steps produce an organized method to accomplishing financial flexibility, changing aspirations into fact.

Conclusion

Involving financial debt professional solutions supplies a critical technique to accomplishing financial obligation relief and financial liberty. Ultimately, the expertise of debt professionals dramatically improves the possibility of navigating the intricacies of financial obligation administration effectively, leading to an extra safe monetary future.

Engaging the solutions of a financial obligation consultant can be a crucial step in your journey in the direction of accomplishing debt alleviation and monetary security. Financial obligation consultant solutions use specialized guidance for people grappling with economic difficulties. By assessing your revenue, financial obligations, and expenses, a financial debt specialist can aid you determine the origin causes of your economic distress, allowing for an extra precise strategy to resolution.

Engaging financial debt specialist solutions provides a critical method to attaining debt alleviation and economic flexibility. Inevitably, the know-how of debt experts considerably boosts the possibility of browsing the intricacies of debt monitoring efficiently, leading to an extra protected economic future.